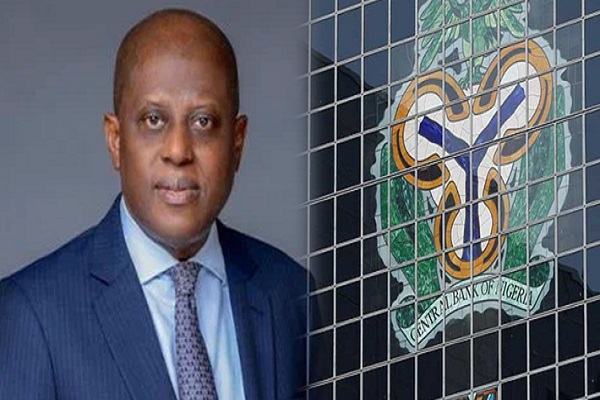

After 9 years of Emefiele who conjured different ways and means to traumatize an entire generation, nous and prudence have been restored to the Apex bank at Plot 33, Abubakar Tafawa Balewa Way, Central Business District, Abuja.

Nigeria’s new Central Banker, Dr Olayemi Cardoso seems to be righting the wrongs of the embattled ex-Central Bank Governor of Nigeria, who oversaw an FX backlog of $7 billion, a 14.02 percent rise on inflation from 8.2% to 22.41% during his reign, reckless abuse of Ways and Means that contravened the CBN Act coupled with shoddy intervention financing, all of which made a mess of CBN’s balance sheet.

In December 2023, the CBN issued a circular which was a thinly veiled dig at the previous management. “In furtherance of the Central Bank of Nigeria’s new policy thrust focusing on its core mandate of ensuring price and monetary stability, the Bank has commenced its pullback from direct development financing interventions – accordingly, the CBN would be moving into more limited policy advisory roles that support economic growth”.

With a series of policy changes in the past quarter, communicated via Friday-released circulars, Nigeria is beginning to witness different reforms that seek to steady the nation’s ship.

So far, remittances have been flowing in through the proper channels, portfolio investors have their interests piqued and market theorists seem to align with his methods in combating inflation with the monetary tools at the bank’s disposal.

So do we still need an economist as CBN governor or do we just need someone who has common sense? Do we need someone who would just focus on the apex bank’s objectives or someone who would gaslight Nigerians to queue under canopies to collect limited redesigned naira notes?

Let’s examine what is the objective of the CBN. The CBN Act of 2007 of the Federal Republic of Nigeria charges the Bank with the overall control and administration of the monetary and financial sector policies of the Federal Government.

The objectives of the CBN are as follows:

●Ensure monetary and price stability;

●Issue legal tender currency in Nigeria;

Advertisement

●Maintain external reserves to safeguard the international value of the legal tender currency;

●Promote a sound financial system in Nigeria; and

●Act as a banker and provide economic and financial advice to the Federal Government.

Now, there were question marks on Dr Yemi Cardoso when he was appointed CBN governor. There were legitimate concerns over how his friendship with the current Nigerian president might affect the independence of the Central Bank. Their friendship began when he first met Tinubu, a Treasurer at Mobil while being a bank officer handling Oil accounts.

There was also worry around Cardoso’s suitability for the role, with preference in some quarters for someone with a strong macroeconomic background, perhaps a Professor in economics who would have the gravitas to turn the tide. However, people largely forget that the CBN has a large army of Ph.D. economists that they can deploy to help guide policy decisions.

“There had been a dislocation of monetary transmission mechanism, for quite some time, which rendered the MPC meetings largely ineffective” – Cardoso said in one of his speeches, as he said the Bank has reviewed the effectiveness of the Central Bank’s monetary policy tools and had spent time fixing the transmission mechanism to ensure the decisions of Monetary Policy Committee (MPC) meetings resulted in desired objectives.

Now he is doing the conventional work needed to battle against inflation which is his prerogative. He has tightened and aggressively hiked rates to an accumulated 600 basis points this quarter. Yields on one-year Treasury Bills now flirt within the 19%-27% range. NAFEM has recorded its highest FX turnover since the beginning of this administration as Naira assets are beginning to look more attractive than holding dollars.

The FX backlog has been cleared and Cardoso contracting Deloitte to work out the invalid claims of about $2.3 billion has proven shrewdness which his predecessor struggled to fathom.

Two interesting things can be observed with his FX management. One, the approach to liberating the FX market with liquidity, and two, the attempt to achieve convergence of the official and parallel market exchange rates. In some developed and stable countries, black market premiums rarely exceed 5%. Black market premiums measure differences between NAFEM rates and the spot rates. At some point in Nigeria, black market premiums exceeded over 20%.

Cynics argue that applauding Cardoso for the recent naira rally after taking the dollar at N700/$1 to the four-digit territory is a bit ironic. However, they forget that at the other end of a lower exchange rate was an ever-growing backlog which in the long run reduces investors’ confidence and stifles liquidity.

Since March 2020, liquidity challenges in the Nigerian foreign exchange (FX) market have consistently affected the accessibility of its equity market, leading to capital repatriation concerns and a significant gap between the official and parallel exchange rates for the Nigerian Naira. This caused global institutional investors to face recurring challenges with index replicability and investability of the MSCI Nigeria Indexes and other indexes they are part of.

Whatever it is, the unorthodoxy of using depleted reserves to heavily defend the currency while dishonoring FX commitments which saw Nigeria relegated to standalone markets with the likes of Argentina seems to be coming to an end.

Cardoso has a lot to do going forward, but market participants see a man who knows what he is doing. He needs some help from the “fiscal side” in the fight against inflation and FX inflows as carry trade from portfolio investors could be evanescent. Crude oil receipts and non-oil export earnings need to come in to support the rates or build the FX reserves.

Cardoso’s onerous task is to tame inflation, however month-on-month inflation has followed an upward trajectory and there’s no assurance it may peak in H1 of 2024. His deployment of monetary tools and FX management would be tested in the long run as without support from his bosom colleague Wale Edun, the Minister of Finance, he may not have enough wriggle room to emerge victorious.

One thing we are encouraged by is that he would not encourage the excesses of the FG and has said CBN will no longer grant loans to FG until the outstanding is paid. By also hiking rates, he has ignored the wishes of the President who prefers a low-interest rate environment to boost economic growth.

For now, it appears there is an end to the days when the Central Bank failed to strictly adhere to the law. They would now limit advances under ways and means to 5 percent of the previous year’s revenue. FG now has to be creative in looking for alternative sources of financing.

But there are a few concerns the CBN governor must begin to consider. How would the CBN resolve its monetary policy conundrums where high MPR is affecting Nigeria’s high growth and employment costs on the economy?

Can interest rates keep following inflation to where it is not known as food inflation and arbitrary price gouging as a result of FX volatility means there’s still some upside for inflation? How long will he hold on to the liquidity ratio with CRR going higher? What are the opportunity costs of liquidity management with yields at 27%?

How does he reform the bank in a way that functionally separates its responsibilities for monetary policy and micro/macro-prudential policies? How does he disprove the Economist’s theory that the CBN is inexperienced in handling a managed float exchange rate system?

When you open the website of the Bank of England, the first thing you see is the tagline “Promoting the good of the people of the United Kingdom by maintaining monetary and financial stability”, it is safe to say that Cardoso and the new Central Bank team is determined to promote the good of the people of Nigeria the same way.

Copied